5 Benefits to Homeownership

In June, we celebrate National Homeownership Month by promoting the benefits of being a homeowner and recommitting to creating opportunities for future homeowners. Achieving homeownership is a journey full of

The Wenatchee Financial Center will be closed on Saturday, December 21st.

Our branches and offices will close at 2 pm on Tuesday, December 24th for Christmas Eve and will be closed all day on Wednesday, December 25th for Christmas Day. Happy Holidays!

Stay informed with the latest insights and updates from our bank

In June, we celebrate National Homeownership Month by promoting the benefits of being a homeowner and recommitting to creating opportunities for future homeowners. Achieving homeownership is a journey full of

Peoples Bank announced the promotion of Amanda Scoby to Senior Vice President, Chief Risk Officer

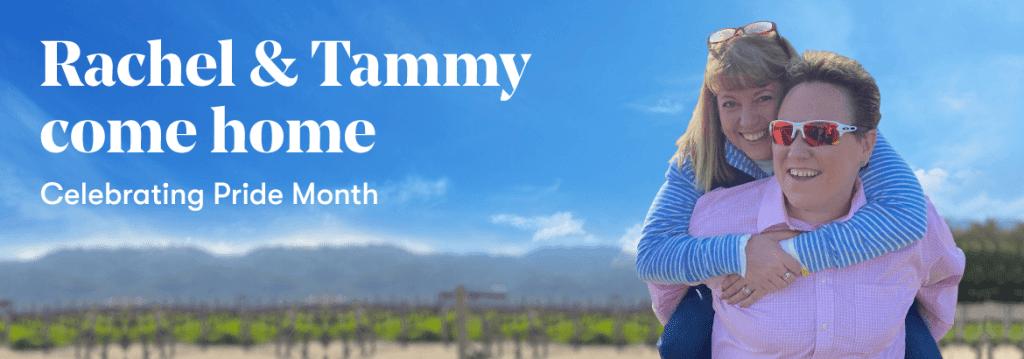

This Pride Month, Peoples Bank Assistant Vice President and Branch Manager Rachel Reim-Ledbetter celebrates her family and the welcoming community they found at her local theatre.

Your daily newsfeed is likely filled with stories of rising prices at both the pump and the grocery store. Economists point to a number of reasons, from the injection of

Peoples Bank announced the hiring of Stephanie Streitler to Vice President, District Branch Manager.

Building on its ongoing growth in Eastern Washington, Peoples Bank announced it will open a new full-service branch in East Wenatchee in 2023.

Business owners who haven’t experienced fraud may have a false sense of security and believe they’re protected, but as criminals get more sophisticated, businesses need to stay even more vigilant.

Peoples Bank announced the promotion of Andy Riddell to Senior Vice President, Chief Lending Officer.

Peoples Bank Vice President and Compliance Manager Amy Brock took steps to become an apiculturist – more commonly known as a beekeeper.

This banking professional teaches financial skills to students at Everett-area schools.

Kevin Alspaugh’s interests are as diverse as one can imagine.

The 30-year-old enjoys geography, rollercoasters, Spanish-language movies, swimming, and snorkeling in the ocean. He’s also extremely creative, sharing his talent

The short answer is yes, depending on the current rates you’re paying, the amount of equity you have in your home, and your long-term goals.

Modal called incorrectly.